Aakruthi Properties

Real Estate Investments v/s Other Investments

June 20, 2019

There are only two different ways to profit in our cutting edge world: by working for yourself or another person, as well as by having your benefits (assets) work for you. If you keep your savings in your back pocket or under a sleeping cushion, rather than investing, the money doesn’t work for you and you will never have more than what you spare or get through legacy. On the other hand, financial specialists/investors generate money by procuring.

There are various ways to invest your hard-earned savings; from land, stocks, bonds, or even gold. All things considered, it is totally simple to even think about becoming immersed with “investment over-burden.” The burden of putting your valuable money in another person’s hands isn’t something to take casually.

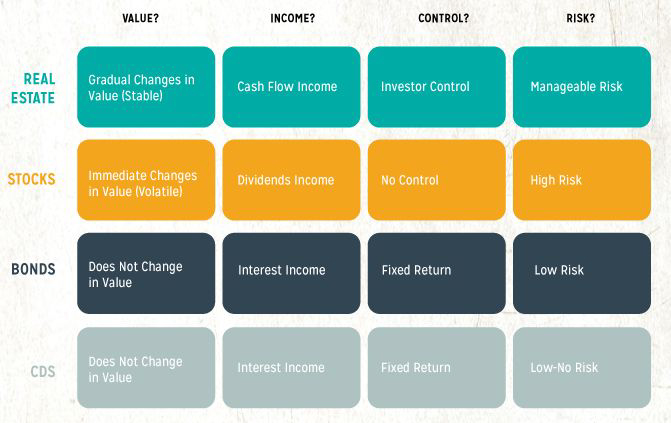

Choosing which investments are directly good for your portfolio will rely upon various variables: the esteem/value, your risk resilience, the potential rate of return, and the measure of control included. With any investment opportunity, there will be an exchange offs; however, real estate speaks to a solid speculation open door for those looking to expand income, put something aside for retirement, and construct a solid monetary portfolio.

A stock, you get proprietorship in an organization. At the point when times are great, you will benefit, However, for a very long time real estate has created steady riches and long haul gratefulness for many individuals. While stocks, bonds, and different types of the asset each hold water in their very own exceptional way, real estate offers something that others can’t: income that is legitimately associated to your very own choices. It’s like your actions are in charge of your overall gain. Different types of investments frequently depend solely on choices made by organization officers.

Real estate investors are accountable for their very own advantages, and there is a great deal to be said for that. Here is a visual breakdown of real estate versus other investments-

It’s increasingly hard to be cheated in real estate contrasted with stocks if you do homework because you can physically appear, review your property, run a personal investigation on the occupants, ensure that the structure is entirely before you get it, and do fixes yourself. With stocks, you need to confide in the administration and the inspectors.

Real estate is an undoubtedly great investment choice. It can create progressing automated revenue and can be a decent long haul asset if the value increments after some time. You may even utilize it as a piece of your general technique to start building your money.